In today’s rapidly evolving digital economy, secure and seamless online transactions are more important than ever. As businesses expand globally, payment gateways have become the backbone of e-commerce, enabling users to make transactions conveniently and securely. However, with this growth comes an increased risk of cyberattacks, fraud, and data breaches. One crucial technology that is helping organizations mitigate these risks while also enhancing system performance is the use of proxies for payment gateways.

Proxies play an integral role in managing data flow between users and servers, offering numerous advantages including improved security, optimized traffic handling, and better compliance. This article explores the function of proxies in payment gateways, their benefits, types, and best practices for implementing them effectively.

What Are Proxies?

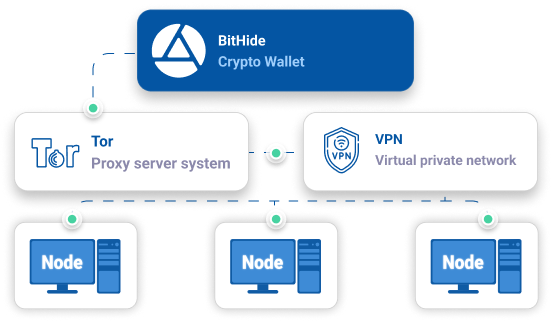

A proxy server is an intermediary between a user’s device and the internet. When a request is made from a user’s browser, it is first sent to the proxy server. The proxy then forwards the request to the target server, retrieves the response, and sends it back to the user. This process masks the original IP address of the user and can control or filter content, enforce security policies, and balance network traffic.

Role of Proxies in Payment Gateways

Payment gateways are platforms that authorize and process payments for online and offline businesses. Security, reliability, and speed are non-negotiable requirements in this domain. Proxies for payment gateways serve as a robust solution for enhancing each of these factors.

Proxies improve the overall architecture of payment gateways by acting as a protective shield between end-users and backend payment processing systems. They can monitor traffic, prevent unauthorized access, mask IP addresses, and even distribute workloads across servers to ensure system availability.

Enhancing Security with Proxies

One of the most compelling reasons to use proxies in payment gateways is to bolster security. With cyberattacks on the rise, protecting sensitive financial data is a top priority for any business operating in e-commerce or fintech.

Data Encryption and Anonymity

Proxies ensure that communication between users and servers is encrypted and anonymized. By hiding the real IP addresses of the payment processing servers, proxies make it difficult for malicious actors to target the infrastructure directly. This anonymity reduces the surface area for potential attacks such as DDoS (Distributed Denial of Service).

Protection Against Fraud

Proxies for payment gateways enable real-time monitoring of transaction data, which helps identify and block suspicious activity. Using behavior analysis and geolocation data, proxies can flag and filter out transactions that deviate from expected patterns. This capability is critical in preventing fraudulent payments and ensuring customer trust.

Access Control and Authentication

Proxies add an extra layer of access control by filtering requests based on predefined security policies. They can also facilitate multi-factor authentication by acting as a checkpoint before a user reaches the payment system, ensuring that only authorized users gain access.

Improving Performance with Proxies

Beyond security, proxies contribute significantly to the performance of payment gateways. A seamless and quick transaction experience is essential to reduce cart abandonment and enhance customer satisfaction.

Load Balancing

Proxies can distribute incoming traffic evenly across multiple servers, ensuring that no single server bears too much load. This load balancing not only improves response times but also prevents server crashes during high-traffic periods, such as holiday sales or product launches.

Reduced Latency

By caching frequently requested data and serving it directly from the proxy server, latency can be significantly reduced. Faster response times lead to quicker transaction processing, which is crucial for a smooth customer experience.

Geo-Targeted Optimization

Proxies for payment gateways allow businesses to tailor their services based on the user’s location. Geo-targeting improves both performance and compliance, ensuring that users get the best experience possible while adhering to regional regulations.

Types of Proxies Used in Payment Gateways

Different types of proxies serve various functions, and choosing the right one depends on the specific needs of the payment system.

Forward Proxies

These proxies sit between the client and the server, intercepting requests from the client before they reach the server. They are ideal for controlling outgoing traffic and are commonly used to anonymize user data.

Reverse Proxies

Reverse proxies sit in front of the server and intercept incoming requests from clients. They are often used for load balancing, encryption, and hiding backend infrastructure.

Transparent Proxies

Transparent proxies do not modify the request or response but are used mainly for content caching and filtering. They offer minimal user disruption and are useful in performance optimization.

Dedicated Payment Proxies

These are specially configured proxies tailored for financial transactions. They support features like PCI compliance, fraud detection, and real-time monitoring, making them ideal for payment gateway applications.

Regulatory Compliance and Data Protection

Compliance with international data protection laws such as GDPR, PCI DSS, and CCPA is crucial for any business handling financial data. Proxies for payment gateways facilitate compliance by ensuring secure data routing, preventing unauthorized data transfer, and maintaining logs for audits.

For example, PCI DSS (Payment Card Industry Data Security Standard) requires that cardholder data be protected during transmission. Proxies can enforce encryption and monitor traffic to ensure that these standards are consistently met.

Best Practices for Implementing Proxies in Payment Gateways

Integrating proxies into a payment gateway architecture requires careful planning and execution. Below are some best practices to ensure optimal results:

Choose the Right Proxy Type

Select a proxy type based on the specific requirements of your payment system. If you need to manage incoming traffic and balance load, reverse proxies are ideal. For outbound traffic control and anonymity, forward proxies are better suited.

Ensure High Availability

Redundancy and failover mechanisms should be in place to prevent downtime. Using a cluster of proxy servers can ensure continuous availability and performance.

Encrypt All Communications

Always use SSL/TLS encryption between proxies, servers, and clients. This ensures that sensitive financial data is protected at every stage of transmission.

Monitor and Audit

Implement real-time monitoring and logging of all proxy traffic. Anomalies should trigger alerts and automatic responses. Regular audits can also help ensure that proxies are configured correctly and are operating within compliance standards.

Keep Proxy Software Updated

Regularly update proxy software to protect against the latest vulnerabilities. Outdated systems are more prone to security breaches.

Conclusion

As digital commerce continues to grow, so do the challenges associated with ensuring secure and efficient payment processing. Proxies for payment gateways offer a powerful solution by enhancing both security and performance. From anonymizing sensitive data and preventing fraud to reducing latency and managing traffic, proxies play a vital role in the modern payment infrastructure.